It’s that time of the year…

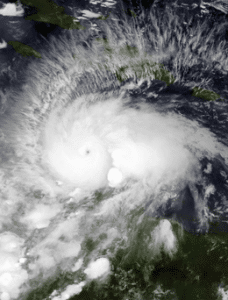

Trees falling. Wind blowing at 145 miles per hour. Floods making it impossible to drive anywhere. Hysteria knows no bounds. Hurricane season is here and boy, has it been a tough one this year.

With Maria, Irma, Jose, Katia as categories 4 and 5 hurricanes all over the US, Puerto Rico, the Bahamas, St. Maarten, Cuba, just to name a few, it’s been a real challenge to stay strong for many people all around the world. Many have lost their homes, belongings, pets and are scrambling to get by. These natural disasters have claimed many lives, with most being related to older people. It is when these types of chaotic events occur that we must help one another and stand by each other’s side through thick and thin.

Table Of Contents

Elderly Liability And Neglect

One example of how others can be forgotten or abandoned during these difficult times lies in elderly care/neglect. In a South Florida nursing home, a group of elderly people died after the home lost its air conditioning amid ongoing, widespread power outages related to Hurricane Irma. Florida is a state that is known for its overwhelming heat. Without proper air conditioning, elderly residents are more likely to suffer heat-related illnesses because of their advanced age. Those who died were between the ages of 71 and 99.

Just a few weeks ago, Puerto Rico and other islands were devastated by Hurricane Maria. At PR’s Las Teresas retirement home, lack of power for lights and elevators left residents stranded in the dark for two weeks after the aftermath of the hurricane. Its two apartment buildings for people older than 62 has residents that are currently dehydrated, without food and low on medical supplies. The latest update was that volunteers came by with supplies and water to help.

Proper protocol in place of a natural disaster

What protocols can you follow pre, during and post a natural disaster?

At Shiner Law Group, it is one of our goals to make sure that you have the right advice to follow when dealing with these tropical cyclones.

Check out the rundown of how to prepare for a hurricane:

- Follow instructions from local authorities if you are instructed to evacuate

- If you must leave your home, make sure to stay informed about the shelter suggestions around your area

- Pack a suitcase of important items (clothing, identification, important belongings) so you are ready to be out the door at any moment

- A complete plan needs to include conditions that will put it in motion, like a chain of command, emergency functions and the team that will perform them, routes and exits for evacuation procedures, accounting for personnel, customers and visitors

- Make sure to have emergency supply kits handy

- Prepare a folder of important papers (power of attorney, living will, trust documents, identification, insurance cards, credit cards, etc.)

- If you are a homebound resident, you need to have a plan in advance so family and caregivers can know and assist to their needs. You must also contact your local special needs shelter or local authorities to notify them of the assistance you will need come evacuation time

- Are you or a loved one living in a nursing home or assisted facility? If so, contact the Administrator and find out about the hurricane preparedness or evacuation plan so you can know it by heart

- If you or a loved one require respirators, oxygen, or other electric medical equipment at the facility, know how those will be maintained at the facility during a hurricane or other disaster

- Register for your local special needs shelter if you or a loved one need to be evacuated from a nursing home or assisted facility

- Timely responses in times of need are critical. Make sure you can stay communicated or in an area with someone you can count on

- If you lose internet, make sure to have batteries and a radio handy to stay up to date on any new updates during the hurricane

- Have a list of contacts written down in case you can’t charge your phone anymore because of a power outage

Need Help with a Hurricane Property Damage Claim? Denied Claim from Insurance?

If you experience difficulties in getting your insurance company to live up to its obligations, an attorney at Shiner Law Group can help you to get things back on track.

Problems You Might Encounter with an Insurance Company After a Hurricane

- Making a lowball initial offer that is beneath the amount your policy is entitled to, in the hopes you’ll be unaware of the discrepancy and agree to it

- Requesting unnecessary paperwork, or paperwork that they know will be difficult or impossible for you to obtain

- Trying to deny repairs or damages that they are legally obligated to pay

- Claiming that damage caused by the storm was pre-existing

Image Source: https://en.wikipedia.org/wiki/Hurricane_Matthew

Living in Florida comes with many wonderful benefits. There are some costs to all these perks, however. Perhaps the biggest cost is the annual hurricane season. At least one tropical cyclone has hit the state every year since 2000. During the prime hurricane season, which runs from June to October, the state usually sees at least $10 million in property damage due to various storms. This number can get up into the tens of billions of dollars with the largest storms, as it did with Charley in 2004 and Wilma in 2005.

Florida law requires that all property insurance sold in the state cover damages caused by a storm that is officially categorized as a hurricane by the National Weather Service. This includes both personal lines (such as a direct policy for your own home or condominium) and commercial lines (insurance provided as part of a lease or membership in an owner’s association). The time period covered extends from when the first hurricane watch or warning is issued through 72 hours after the final watch or warning. This insurance is required to cover damage from wind, all forms of precipitation, sand and dust that occurs both outside and inside of a structure.

If your property is in the path of a hurricane, the ideal situation is that there is no bodily injury and that your insurance company promptly upholds its financial obligations to you. Unfortunately, insurance companies don’t always live up to these obligations. They may try to avoid approving your claim, or make an offer that is substantially lower than the compensation you are entitled to. They may also try to unreasonably delay your claim through a variety of means.

If you experience difficulties in getting your insurance company to live up to its obligations, an attorney can help you to get things back on track.

How Shiner Law Group Can Help

You have a legal right to dispute questionable actions and refusals made by the insurance company. Florida common law recognizes “bad faith” claims against insurers when they can be shown to intentionally be trying to slow up or unfairly deny or limit a claim. Insurers are required by the state to be fair and act in good faith, whether processing a claim from a customer or defending a customer against a third-party claim.

Bringing these matters to court is tricky and requires the assistance of a professional attorney, however. Without an attorney, a case is extremely likely to be thrown out. Shiner Law specializes in Florida hurricane insurance claims and has over a decade of experience in representing property owners and renters who have been wronged by their insurance company.

We’d love to help you to get the compensation you deserve. Call Now for a FREE Immediate Phone Consultation at 561-777-7700, 24 hours a day. Our operators will begin processing your case and get you set up with an appointment time that works for you.

For more information on how to prepare and stay safe during a moment of emergency, visit the following link: redcross.org

We hope these points were helpful. Please stay safe and remember: Shiner Law Group’s team is always here for you, come rain, shine or storm.

If you or someone you love has died because of the negligent, reckless or intentional conduct of another, we welcome you to contact our experienced legal team so that we can evaluate your claim and advise you of your rights and options. We are committed to helping victims recover the compensation they need to move past injuries or loss, so call us 24/7 at 561-777-7700 or online for a free case review to see how we can help.