Accidents on Florida roadways occur every day. While many are minor, leaving you with nothing more than minor property damage, others are more serious and can have life-long consequences.

Table Of Contents

Car Accident Settlement Process and Timeline

If you are involved in an accident that is not your fault, you may wonder what options you must recoup your losses. One of the best things you can do in these situations is to hire an experienced car accident lawyer who can help with your case each step of the way.

Along with retaining legal representation, it’s also smart to learn more about car accident settlements in Florida, what to expect from the process, and more.

While each accident is unique, and therefore the settlement process won’t be the same for everyone, there are some general things you can expect to happen.

Steps to Take After a Car Accident

As a Florida driver, it’s important to know when you need to contact a law enforcement officer about the situation. If your accident involves property damage of more than $500, death, or an injury, a sheriff’s deputy or police officer needs to be contacted and come to the scene to file a police report. If you are involved in an accident that doesn’t require a police report, you should still file an accident report within 10 days of the accident.

If you are involved in an accident, it’s required that you provide “reasonable assistance” to anyone who may have been injured. There’s also the expectation that you exchange information with all drivers involved in the accident.

If possible, get the names and phone numbers of witnesses of the accident, take time to document the scene, and take photos if possible. Even if you believe you caused the accident, you should never say this to anyone at the scene.

Contact Your Car Insurance Company

Florida is a “no-fault” state. This means that your insurance provider will cover your bills and costs, no matter who was at fault. However, it’s possible to pursue a claim against the insurance provider for any property damage to your vehicle.

Once the accident happens, make sure you get in touch with your insurance provider. It’s necessary to find out what steps you must take to file the claim. If you (or someone else at the scene) require medical attention, make sure to get it right away.

Understanding Statute of Limitations in Florida Car Accident Cases

In the state of Florida, the statute of limitations for car accidents depends on if it resulted in an injury or death. If an injury resulted from the accident or vehicle damage occurred, you have up to two years to file a lawsuit after the date the accident occurred. However, if someone passes away because of a car accident, you must file a wrongful death lawsuit. In this case, you have just two years to file the claim.

It’s important to note that you forfeit your right to do so if this time period passes and you have not filed a lawsuit.

Understanding the Settlement Offer

The settlement amount you receive (or are offered) for your car accident varies. The amount is dependent on several factors, including property damage, physical injuries, severity, and more. If you only experienced vehicle damage in the accident, the insurance company will probably only pay out the “reasonable” value of the vehicle’s replacement or repair.

As mentioned above, if your property damage exceeds $500, then you may be able to file a lawsuit and fight for damages from the at-fault driver to cover your property or vehicle repair or replacement costs.

If you experienced an injury because of the accident, then this part of your settlement case will be negotiated separately from the property damage portion. The amount you receive from the insurance company is typically determined by factors like the extent of your injuries, lost income, and medical expenses.

Settlements for pain suffering are used to compensate for past and future issues related to the injuries you experienced during the accident. Ensuring you complete your medical treatment and a release from your doctor are needed before submitting this part of your settlement claim.

Remember, insurance will only give you one settlement for pain and suffering compensation. Because of this, it is imperative that you fully understand your medical condition and if you will need additional healthcare services for the remainder of your life. Because of this, it is important to consult with a personal injury attorney to talk about the settlement process that includes ongoing medical care and lasting pain from the accident. Doing so will help ensure you don’t waive the options you have to receive medical treatment for accident-related injuries in the future.

Accident-Related Costs and Your Settlement

In the state of Florida, most drivers carry just $10K in medical care insurance coverage through their policies. If you are involved in an accident that results in your bills piling up, it’s good to hire an experienced car accident attorney and have them help you with the settlement offer.

Your Medical Related Costs

The medical bills you receive from an accident vary based on how severe the accident was. Minor accidents may require that you go to the ER or schedule an appointment with a chiropractor to help with a stiff back or neck. If you are involved in a more serious accident, then you will likely have more medical bills, which may include transport from the scene via an ambulance, the ER doctor’s bill, hospital admission, radiology bills, and other post-care services, such as in-home care or physical therapy. You must maintain detailed records and copies of all your bills after your car accident to ensure the settlement offer accounts for all this.

Lost or Damaged Property

As mentioned above, if your vehicle experiences more than $500 in damages, then you can ask for reimbursement for this in the settlement you receive from the insurance company of the at-fault driver. If you had personal items of value in your car that were lost or damaged during the accident, you could include these items in your settlement, as well.

Medication Costs

While you would not need medication to treat your ailments or pain resulting from the accident in an ideal situation, this isn’t always the case. In fact, many people are prescribed several prescriptions to help them live day-to-day without pain. In most cases, health insurance policies will cover the cost of these medications. While this is true, it’s still smart to record all prescriptions that your doctor gives you after the accident.

Hospital Stay

It’s estimated that the average cost to stay in the hospital in Florida ranges between $1,500 and $2,250 per day. Many car accident injuries won’t require you to stay overnight in the hospital, but others may require observation. One example is if you have a spine, neck, or head injury. It’s good to maintain a copy of all these bills and give them to your personal injury attorney so the costs can be accounted for in your settlement.

Rehabilitation

More serious car accidents may leave you (a driver) or your passengers injured and in bad shape. Sometimes, the recovery time for these significant injuries is high in a personal injury case. Physical therapy and rehabilitation are required to help restore strength, flexibility, and range of motion during recovery.

Lost Wages

If an accident leaves the driver or passenger injured and in a position where they cannot go to work, lost wages arise. Talking about your lost income is essential during your initial consultation with an attorney. An experienced attorney should be able to provide you with some type of action plan to make sure that you and your family will not suffer without your income while you recover.

Medical Equipment Cost

Ramps, crutches, wheelchairs, and other accessibility tools required to get around your home are just a few pieces of medical equipment that may be needed for your recovery after an accident. While your health insurance may cover these items, you need to make sure that you save all documentation and receipts for the medical equipment you need after an accident. In some situations, the costs will be included in your settlement payout.

Expenses You Pay Out of Pocket

Around 27 million people in the U.S. do not have health insurance. If you don’t have health insurance coverage, this can result in several bills that you must pay out of pocket. It’s up to you to record the expenses you pay out of your own pocket related to the accident and give them to your attorney so they can be included in the settlement you receive.

Important Information About the Settlement You Receive

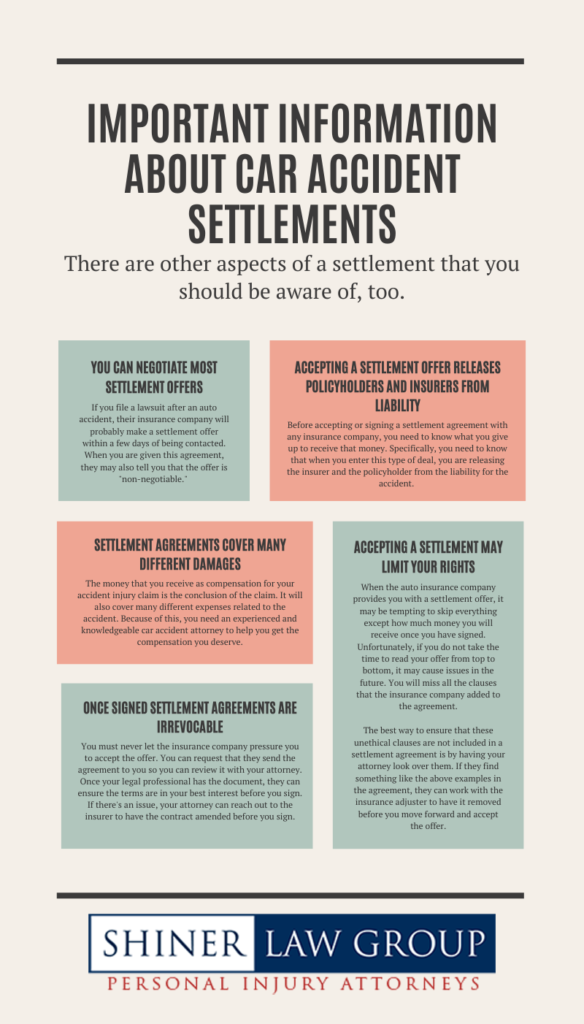

There are other aspects of a settlement that you should be aware of, too. This information will help you get the compensation deserved after an accident.

You Can Negotiate Most Settlement Offers

If you file a lawsuit after an auto accident, their insurance company will probably make a settlement offer within a few days of being contacted. When you are given this agreement, they may also tell you that the offer is “non-negotiable.”

However, this is rarely the case. Because insurance companies are out to protect their bottom line, they will make a low offer at first, in hopes you will accept it. Be sure to speak to an attorney about the offer to find out if it is fair. If it is the first offer, you can feel almost 100% confident that you can get more with negotiations.

Accepting a Settlement Offer Releases Policyholders and Insurers from Liability

Before accepting or signing a settlement agreement with any insurance company, you need to know what you give up to receive that money. Specifically, you need to know that when you enter this type of deal, you are releasing the insurer and the policyholder from the liability for the accident.

However, this release doesn’t just free them from liability for the injuries that were noted in the original accident claim you filed. It also ensures you can’t hold them responsible in the future for health issues that may pop up due to the accident.

If your doctor happens to diagnose you with a neck or spine injury six months after your accident, and you have already agreed to a settlement, you cannot take further legal action against the policyholder or the insurer. Instead, you must cover the costs of these injuries or issues yourself.

Settlement Agreements Cover Many Different Damages

Some people believe that a settlement that is paid after a car accident will only help the accident victims cover their medical costs. The truth is, though, when you negotiate a settlement deal with an auto insurance company, you can also receive compensation for the following:

- Loss of enjoyment of life

- Ongoing healthcare bills

- Pain and suffering

- Rehabilitation costs

- Loss of future earning capacity

- Property damage

- Mental anguish

The money that you receive as compensation for your accident injury claim is the conclusion of the claim. It will also cover many different expenses related to the accident. Because of this, you need an experienced and knowledgeable car accident attorney to help you get the compensation you deserve.

By having a knowledgeable car accident attorney evaluate your claim, the money you receive won’t depend on how “kind” the insurer is.

Instead, it is going to depend on factors like:

- The costs related to initial medical care

- Fees related to ongoing healthcare needs

- Cost of rehabilitation and physical therapy

- Charges for repairing or replacing broken property

- Total number of days missed from work due to the injury

- Effect the injury has on your ability to keep working

- Mental anguish caused by your injury

- Impact of the injury on your quality of life

- Liability limits on the auto insurance policy held by the at-fault party

Also, if the other party acted with malice, then the award you receive may also include exemplary or punitive damages.

Accepting a Settlement May Limit Your Rights

When the auto insurance company provides you with a settlement offer, it may be tempting to skip everything except how much money you will receive once you have signed. Unfortunately, if you do not take the time to read your offer from top to bottom, it may cause issues in the future. You will miss all the clauses that the insurance company added to the agreement.

It isn’t uncommon for an auto insurance company to hide lines in a settlement agreement that can limit your rights or your options for legal action. Some of the common limitations that are included in these settlement offer that you should be aware of and look for include:

- Mandatory arbitration for resolving disputes

- Rules about how you can spend the money received

- Strict payment schedules

The best way to ensure that these unethical clauses are not included in a settlement agreement is by having your attorney look over them. If they find something like the above examples in the agreement, they can work with the insurance adjuster to have it removed before you move forward and accept the offer.

Once Signed Settlement Agreements Are Irrevocable

Once you sign a settlement contract, you should know that they are almost always irrevocable and binding. This means that you can’t attempt to negotiate the deal later on. The agreement is final and has to be taken as-is.

Due to the irrevocable nature of these settlement contracts, you must never let the insurance company pressure you to accept the offer. You can request that they send the agreement to you so you can review it with your attorney. Once your legal professional has the document, they can ensure the terms are in your best interest before you sign. If there’s an issue, your attorney can reach out to the insurer to have the contract amended before you sign.

Understanding Your Settlement Offer After a Car Accident in Florida

As you can see, there are more than a few things you should know and understand about car accident settlement offers. If you aren’t informed, you may not get what you deserve or agree to terms that aren’t in your best interest.

The best way you can avoid both these outcomes is by hiring and using the services of an experienced personal injury accident attorney. Doing so means you have someone in your corner, fighting for your rights and working to ensure your settlement offer is fair. Remember, you have rights. One of these rights is to ensure you get the compensation deserved for the accident and resulting injuries. Keep this in mind as you move forward with your accident claim.